Commercial real estate investors have many aspects to consider in the current market, with the Federal Reserve beginning the process of quantitative tightening, the rise in interest rates, and inflation. What have these changes led to? The go-to financing options of commercial real estate investors are shifting.

Since the Great Recession of 2008, traditional lenders, such as commercial banks and insurance companies, have become more conservative in their underwriting and financing for commercial real estate. These limitations have caused real estate investors to shift towards alternative lending options to find an opportunity and fill the gap left by traditional financial institutions.

The combination of tightened regulations, rising borrower demand, and the spike in interest rates have allowed alternative lenders to grow their impact on the world of commercial real estate investing.

Let’s discuss how CRE investors are moving towards alternative lending trends. But first, let’s take a look at how a recession affects commercial real estate.

How Does a Recession Affect Commercial Real Estate Investing?

What is a Recession?

A recession is “a macroeconomic term that refers to a significant decline in general economic activity in a designated region. It had been typically recognized as two consecutive quarters of economic decline, as reflected by GDP in conjunction with monthly indicators such as a rise in unemployment.”

The National Bureau of Economic Research (NBER), which officially declares recessions, however, claims that the two consecutive quarters of decline in real GDP are no longer an adequate definition. Instead, the NBER defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

How Will These Shifts Affect Commerical Real Estate Investing?

Real estate cannot be bought and sold as quickly and easily as other investments, such as stocks and bonds. Due to this delay, real estate typically maintains an illiquid nature and will take longer to respond to economic shifts. It may take months for the effects of declining yields to be realized. Further, CRE may carry these effects longer than other asset classes.

Commercial Real Estate Prices Will Likely Decline

During a recession, commercial real estate prices will almost always decline to some degree as a response to the shifts in the economy. Due to these lower prices, some investors may be more attracted to buying opportunities in a recession instead of when the economy is stronger and the prices are higher.

Why Are Commerical Real Estate Investors Choosing Alternative Lending During a Recession?

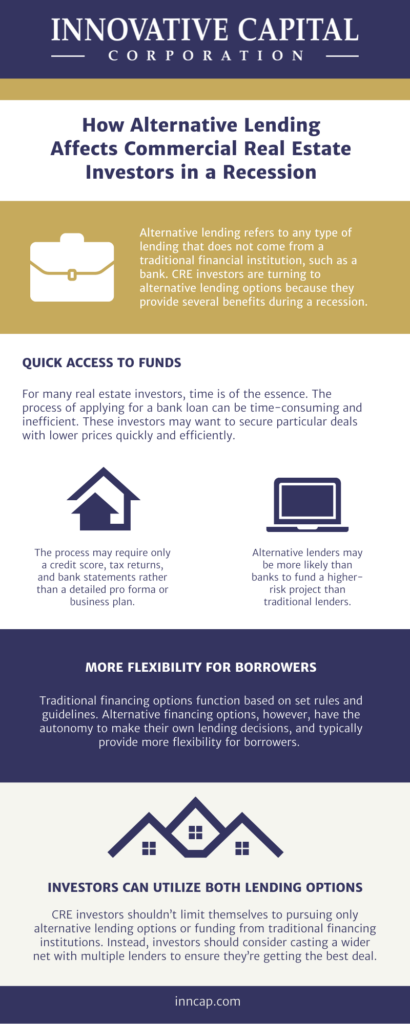

Alternative lending refers to any type of lending that does not come from a traditional financial institution, such as a bank. CRE investors are turning to alternative lending options because they provide several benefits during a recession. Let’s review what some of those benefits may be.

Quick Access to Funds

For many real estate investors, time is of the essence. The process of applying for a bank loan during a recession can be time-consuming and inefficient. These investors may want to secure particular deals with lower prices quickly and efficiently.

While most banks and conventional lenders could take weeks to approve or deny a loan application, many alternative lenders can deliver funding in just a few days.

More Lenient Guidelines

In traditional lending options, the strict regulations and underwriting criteria of each lender often result in a loan denial. In contrast, the loan application process for alternative loans tends to be simpler. The process may require only a credit score, tax returns, and bank statements rather than a detailed pro forma or business plan.

Higher Approval Rates

Commercial banks approved only 27.3% of submitted loan applications in 2019. Alternative lenders may be more likely to fund a higher-risk project than traditional lenders.

More Flexibility For Borrowers

Traditional financing options function based on set rules and guidelines. Alternative financing options, however, have the autonomy to make their own lending decisions, and typically provide more flexibility for borrowers.

For example, alternative lenders are more likely to offer loans in smaller amounts than banks, which may include minimum lending requirements. Additionally, alternative lenders may offer a variety of types of loans, ranging from lines of credit to hard money loans, to help borrowers fund their ventures.

Examples of Alternative Lending Options

Bridge Loans

A bridge loan, or bridge financing, is a short-term loan in which a borrower funds a project through personal collateral. Bridge loans can be secured through collateral such as the borrower’s home or other assets.

Hard Money Loans

A hard money loan is a type of loan secured by real property. Hard money loans are associated primarily with real estate transactions.

For more information, learn the pros and cons of hard money loans, here.

Asset-Based Loan

In an asset-based loan, the borrower can use an asset to secure a loan. The assets themselves are the collateral for lenders. An asset-based loan may be secured by:

- Accounts receivable

- Equipment

- Inventory

- Other property owned by the borrower

Lines of Credit

A line of credit, also known as a credit line, is a revolving loan that a borrower can access and use at any time on one specific project approved by the lender.

Commercial Real Estate Investors Aren’t Limited to Choosing Alternative or Traditional Lending Options

CRE investors shouldn’t limit themselves to pursuing only alternative lending options or funding from traditional financing institutions. Instead, investors should consider casting a wider net with multiple lenders to ensure they’re getting the best deal possible. This is essential in CRE investing during a recession and rising interest rate environment.

Learn more about how to ensure you’re getting the best deal as interest rates soar, here.

Not sure how to cast out multiple lines to connect with several lenders to underwrite the request simultaneously? Luckily, that’s exactly what we do at Innovative Capital Corporation.

How Innovative Capital Can Help Commerical Real Estate Investors in a Recession

Our reputation is built upon an honest, straightforward approach that can fund loans within seven days, solve complex financing challenges, and find the best rate and terms for our clients.

We serve our clients by leveraging:

- Our experience

- A constantly-evolving bank network

- In-house private capital

We Leverage Offers For You

Rather than surveying one option at a time, our Innovative Capital team shares borrowing needs with a diverse selection of lending partners we think will be interested in funding your business needs.

Our resources allow us to leverage multiple offers from different locations to find the most beneficial deals for our clients.

We Have Experience in Recessions

Innovative Capital Company began in 2007 with the intention of providing innovative solutions for our clients seeking capital. The timing of our founding aligned with the last Great Recession and tested just how innovative our company was.

We use this experience to service our clients and help them navigate a similarly challenging market.

Ready to Get Started?

Review our recently funded loans or our rates, here. Depending on the unique needs of our clients we have the lending solution. Please reach out if you’re in need of a free quote.

Interesting in investing in commercial real estate? Consult with us today. It’s the future of the economy.