The process of traditional lending typically involves a borrower visiting a financial institution and trusting a single banker to find the best rates and terms for their loan. This process can take months and, due to each lender’s strict guidelines and varying underwriting criteria, often results in a decline. In fact, commercial banks approved only 27.3% of submitted loan applications in 2019.

Innovative Capital’s team consists of commercial bankers that are inspired to improve the results we provide our clients. We feel that a 27.3% approval rate isn’t good enough. We have the knowledge, network, and technology to provide our clients with a strategic advantage. Putting all of your eggs in one basket and applying for a loan with one bank can lead you to a path of frustration and headache. When you work with our team, we take the same loan application a bank would provide and then prepare your loan to be introduced to multiple banks. This strategy provides our clients with:

- A professional in your corner to do the work for you so you can focus on your business and family.

- Correctly present your loan request with underwriting in mind. You don’t have a second chance to make a first impression with lenders.

- Reduced Risk of having your loan declined with no backup options

- Options to choose the loan that is best suited for their business

- The knowledge that you’re getting the best rate and term

- Access to quick funding when needed. We can fund in as little as 7 days utilizing in-house private capital.

Depending on the unique needs of our clients we have the lending solution. Please reach out if you’re in need of a free quote.

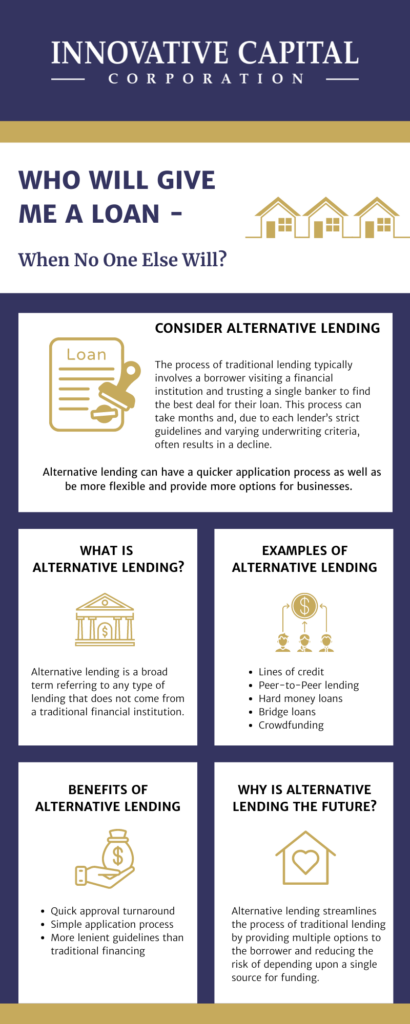

Read on to learn what alternative lending is and how these strategies can be useful solutions for your business.

Alternative Lending

Alternative lending is a broad term referring to any type of lending that does not come from a traditional financial institution, such as a bank. Alternative financing is an option for those who need funding in a timely manner or maybe having difficulty being approved for traditional loans.

Alternative lending often has the benefits of:

- Quick approval turnaround

- Simple application process

- More lenient guidelines than traditional financing

- Reduced risk of depending upon a single source for funding

Read on to learn a few examples of alternative financing.

Lines of Credit

A line of credit, also known as a credit line, is a revolving loan that a borrower can access and use at any time on one specific project approved by the lender.

The lender decides the total amount of credit to extend to the borrower, and the borrower can access funds up to the maximum amount. When the amount they borrowed is paid back with interest, the limit returns to its original value.

Peer-to-Peer Lending

In the past decade, peer-to-peer (P2P) lending has become a trendy, growing method to fund small businesses. According to Investopedia, P2P lending “enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman.”

Lending partners, like Innovative Capital, connect borrowers directly to investors. Since Innovative Capital sources multiple lenders, this partnership will provide the borrower with options as investors compete to set the best rates and terms.

Crowdfunding

Crowdfunding, very similar to peer-to-peer lending, is the process of funding a project by connecting to multiple investors. Crowdfunding is often associated with public campaigns to raise capital, whereas P2P lending usually requires a formal application to connect to private investors.

Both peer-to-peer lending and crowdfunding have their benefits as methods of alternative financing. Learn more and find out which is right for your business by scheduling a meeting with us today.

Bridge Loan

A bridge loan, or bridge financing, is a short-term loan in which a borrower funds a project through personal collateral. Bridge loans can be secured through collateral such as the borrower’s home or other assets.

While bridge loans are typically associated with higher interest rates, they also can provide several benefits, such as a faster application and underwriting process as well as flexibility for the borrower.

Hard Money Loan

A hard money loan is a type of loan secured by real property. Hard money loans are associated primarily with real estate transactions and are typically funded by private investors or companies instead of large commercial banks. These loans can provide the benefits of:

- While typical bank loans can take upwards of 30-60 days to be approved, hard money loans can close in just a couple of days

- Borrowers and lenders can both negotiate the terms of a deal

- Hard money lenders often prioritize the value of the property itself over the borrower’s credit score

For more information, learn the pros and cons of hard money loans, here.

Asset-Based Loan

In an asset-based loan, the borrower can use an asset to secure a loan instead of relying on credit scores. The assets themselves are the collateral for lenders. An asset-based loan may be secured by:

- Accounts receivable

- Equipment

- Inventory

- Other property owned by the borrower

For more information and examples of alternative financing, learn why alternative lending is your best-kept secret, here.

Why does Innovative Capital Utilize Traditional and Alternative Lending?

Alternative lending seeks to streamline the process of traditional lending by providing multiple options to the borrower and therefore reducing the unnecessary risk of depending upon a single source for funding.

In an ideal situation, instead of casting out one line, the borrower could cast out multiple lines and connect with several lenders to underwrite the request simultaneously.

Luckily, that’s exactly what we do at Innovative Capital Corporation.

How Can Innovative Capital Corporation Help?

At Innovative Capital Corporation, our goal is to find innovative solutions to secure the best rates and terms for our clients.

Rather than surveying one option at a time, our Innovative Capital team shares borrowing needs with a diverse selection of lending partners we think will be interested in funding your business needs. Our resources allow us to leverage multiple offers from different locations to find the most beneficial deals for our clients.

The best part? If you’re not happy with the deal(s) that we present to you as options, you don’t pay us. We’re so confident in our ability to find you the best deal to meet your business’ needs that you only pay our fee if you decide to take our deal.

Get started with Innovative Capital today and learn how we can help find the best deals for your business needs. Still have questions? Read our guide to alternative lending for small businesses.