Purchasing a property with the intention of flipping it for resale or business use is a common endeavor. While the entertaining house flipping shows on TV might make it look like a walk in the park, flipping houses is often easier said than done.

Fix and flip projects require significant capital to be able to not only purchase the property but also front construction and material costs. Realistically, the most challenging part of a fix and flip project is obtaining the financial capital to make it a reality.

While it may be a challenge to secure the funding needed to get your project started, it’s hardly impossible. With alternative lending the future of finance, you have more options than ever to find the funding your project needs to get off the ground.

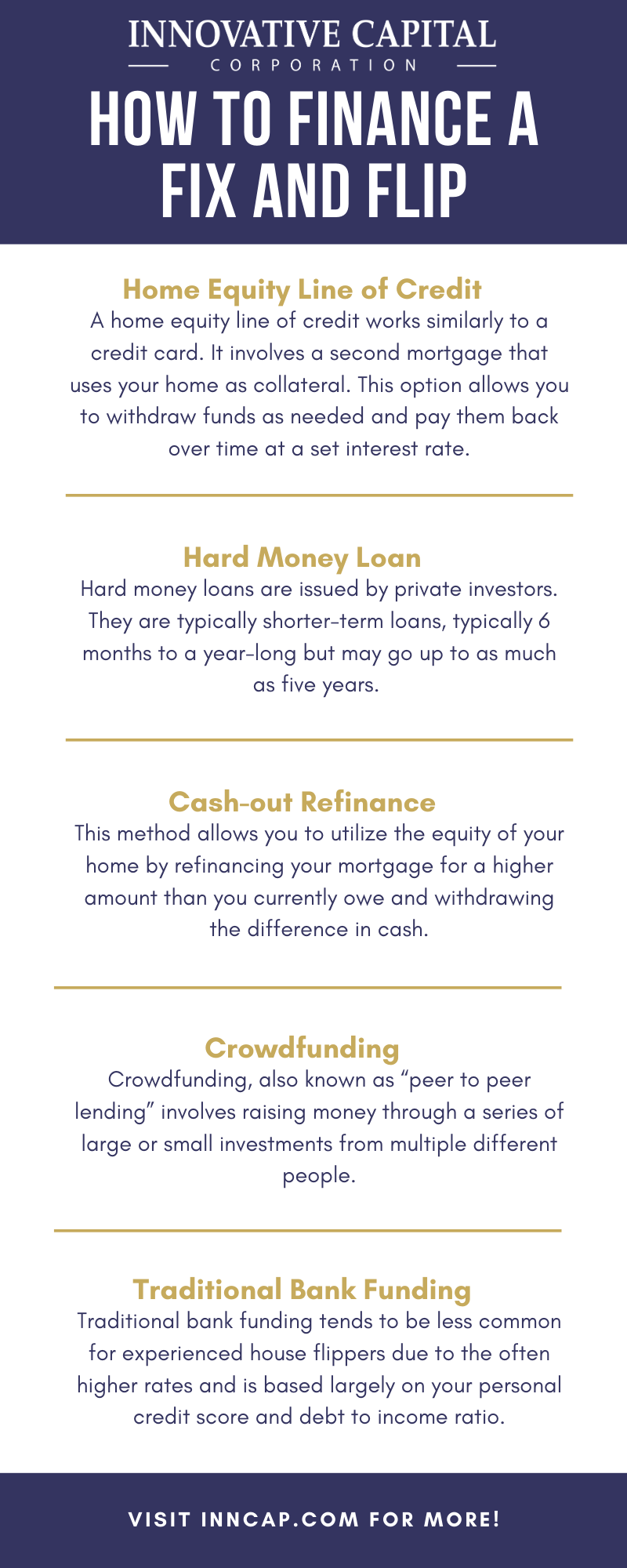

Hard Money Loan

Hard money loans are issued by private investors as opposed to traditional loans backed by banks. They are typically shorter-term loans, typically six months to two years, but may go up to as much as five years. Additionally, hard money loans are typically interest only and average interest rates range from 8-15%.

The upside of pursuing a hard money loan is that they offer additional solutions and can close quickly within 7 business days. They often don’t require the same extensive paperwork as banks usually do so the process of receiving the loan is often less stressful than a traditional loan.

Cash-out Refinance

If the value of a commercial property has increased since you purchased it, a cash-out refinance may be a good option for you to pursue. This method allows you to utilize the equity of your property by refinancing your mortgage for a higher amount than you currently owe and withdrawing the difference in cash.

The outcome of this method is that your new loan will be the original amount that is still owed on your original mortgage, PLUS the amount that you took out in cash. We’ll provide an example: Say your existing mortgage has a remaining balance of $500,000 and you want to cash out $500,000 for an upcoming project. You would replace your existing mortgage loan with a $1,000,000 loan and use the extra $500,000 for your project.

Home Equity Line of Credit

A home equity line of credit works similarly to a credit card. It involves a second mortgage that uses your home as collateral. This option allows you to withdraw funds as needed and pay them back over time at a set interest rate. As is the case with a credit card, as you repay the balance, the funds will replenish.

Banks offer a line of credit based on the value of your home or property. Depending on your credit score and other factors, current rates range from 2.49 to 21 percent.

This financing method is likely best suited for long-term projects rather than investors looking to quickly flip a property for resale purposes. Since you have to pay your balance to replenish funds similar to a credit card, it may be a challenging solution for projects that require higher upfront costs.

Crowdfunding

Crowdfunding, also known as “peer-to-peer lending” involves raising money through a series of large or small investments from multiple different people. On a case-by-case basis, this may include investments from family or friends or internet sites that help borrowers solicit the funding needed for their projects.

Investors involved in crowdfunding typically either make their money back in interest payments or by sharing the profits from the project. As it’s still a relatively new option for financing, crowdfunding is considered by some to be particularly risky.

Traditional Bank Funding

Last but not least, is traditional bank funding. Traditional bank funding tends to be less common for experienced house flippers due to prepayment penalties and the speed to close. Banks typically charge penalties for borrowers that pay off loans early. Traditional bank financing is also based largely on your personal credit score and debt to income ratio. While the project your financing may be business-based, some lenders are wary of lending to individuals below a certain threshold.

As real estate fix and flip projects continue to gain popularity, so does the need for the availability of capital. Luckily, in combination with alternative financing becoming the future of finance, borrowers have more options than ever when deciding where to obtain the capital needed to start their new projects.

Innovative Capital is positioned as an ideal partner for fix and flip investors being that we offer multiple variations of lending options under one brand. Our experienced loan officers can offer private money loans, in addition to independent lenders and traditional banks. With our team, we do our best to survey all of your available options and get you the best deal possible based on the resources available to you.