How the Federal Reserve will Impact Market Liquidity

In January of 2022, the Federal Reserve announced plans to reduce its balance sheet. This process will affect a variety of factors, including market liquidity.

Let’s discuss how the Fed withdrawing its support from the market will impact market liquidity.

What is Market Liquidity?

Market liquidity refers to the “extent to which a market allows assets to be bought and sold at stable, transparent prices.” Liquidity applies to any financial market, such as a country’s stock market or a city’s real estate market. Some markets are more liquid than others.

What Causes Market Liquidity?

Market liquidity is caused by trading activity. High levels of trading activity suggest there is both a supply and demand for an asset. This environment allows sellers to easily find someone to purchase their asset, resulting in an easy transaction with little effect on the market price.

However, in a market with low trading activity, transactions can take longer due to a lack of willing participants. Once the sale has occurred, the market value of the asset may be affected to account for the limited number of buyers and sellers.

Why is Market Liquidity so Important?

Financial markets require enough liquidity to ensure that buyers and sellers can efficiently exchange assets and investment instruments. Further, market liquidity is tied to price volatility. Wide swings in prices can reduce demand.

In terms of the stock market, market liquidity is important as it affects trade costs and therefore, impacts returns to investors.

Now, let’s discuss how the Federal Reserve’s decision is affecting market liquidity.

How is the Federal Reserve’s Decision Affecting Market Liquidity?

The Federal Reserve uses its balance sheet to accomplish these goals:

- Promote maximum employment

- Stabilize prices

- Moderate long-term interest rates

- Ensure stability of the financial system

The majority of these items on the Fed’s balance sheet include bills, notes and bonds issued by the Treasury. However, approximately a third of the Federal Reserve’s balance sheet consists of mortgage-backed securities.

Why does the Fed Own Mortgage-Backed Securities?

The concept of the Federal Reserve owning mortgage-backed securities originates from the financial crisis of 2008 and 2009.

During this crisis, every financial institution had exposure to the U.S. housing system but had no interest in purchasing more housing bonds due to the poor economic environment. The Fed stepped in as a final resort and served as a buyer to keep the market from collapsing.

Similarly, after the economic shutdown during the COVID-19 pandemic, the Federal Reserve bought debt securities and held them on its balance sheet. The Fed did this to increase their price and lower yields, as well as stimulate economic activity. This process is called quantitative easing.

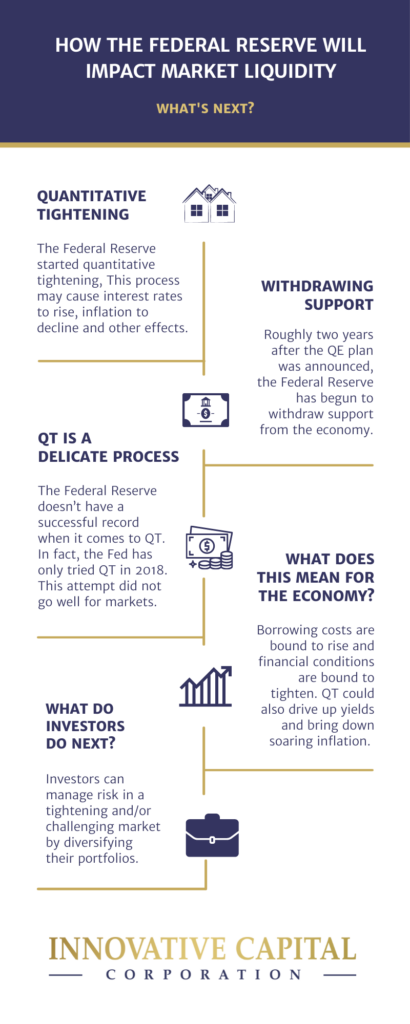

However, the Fed entered a phase of quantitative tightening on June 1st, 2022, meaning it is withdrawing support from the economy and allowing these existing mortgage bonds to expire.

How Will the Federal Reserve Affect Market Liquidity?

As the Fed is set to allow bonds to mature off its $9 trillion balance sheet, the market faces risks to liquidity.

Market liquidity may weaken due to the missing opportunity to sell bonds to the Fed. A significant risk is that the market will prove to be unable to absorb the additional supply of bonds and other assets. These changes may increase volatility.

Changes to Market Liquidity Will Likely Be Gradual

According to financial experts, it is still too soon to predict the full effects of quantitative tightening on the economy. The changes will likely be gradual as the Fed is taking time to build up its cap of “$95 billion in bonds that it will allow to roll off its balance sheet each month.”

“This will include $60 billion in Treasuries and $35 billion in mortgage-backed debt and will fully take force in September. These caps will be $30 billion and $17.5 billion, respectively, until then.”

How Should Investors Prepare?

Investors can prepare to manage these risks by diversifying their portfolios and enlisting the assistance of experienced professionals. Navigating a tightening market can be difficult for an investor.

How Innovative Capital Corporation Can Help You Prepare

Luckily, this isn’t our first time in a challenging market. In fact, Innovative Capital Corporation was started during the recession in 2008. For the last twenty years, our company has survived the difficult phases of the market and learned to navigate challenging times. We bring this experience into every deal with our clients.

We are ready to work with investors on out-of-the-box solutions, such as:

- Commercial Lending

- Private Capital

- Factoring

- Business Debt

- Foreclosure bailouts

- Purchasing debt

We have lending solutions to fit the unique needs of our clients. Please reach out if you’re in need of a free quote.

Learn more about us, here, or read on for more information about the top five reasons banks turn down loan applications.